Vision

VAMTAJ is the family office of an innovative entrepreneur who has nurtured success in multiple business enterprises in diverse sectors such as construction and biotech.

Established in 2016 in Luxembourg and founded on core values of investment in innovation, long-term value creation, operational excellence and commitment to quality, the VAMTAJ team supports our founder to actively contribute to ambitious development projects in France, Switzerland, Luxembourg, the USA and Asia. We drive the finance and the international development of the Groupe.

The strength of VAMTAJ is our intimate understanding of elements essential to entrepreneurial success: the value of people, differentiation beyond price, permanent attention to customers and, above all, persistence and sustainability in operational and financial efforts. We aspire to transform life and business.

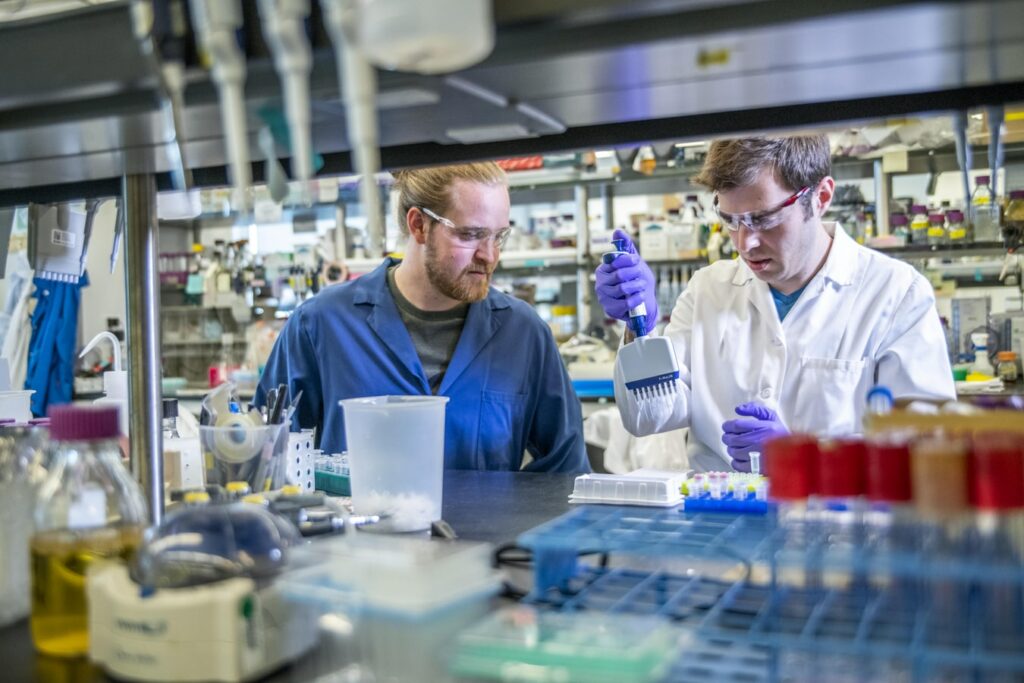

This ambition is reflected not only through VAMTAJ’s business ventures, but also philanthropic commitments, with significant support given to a foundation dedicated to groundbreaking research into human longevity.